Looking Good Tips About How To Settle With The Irs

Another option for settling your debt is to offer the irs an “offer in compromise.” this is basically where you offer to pay the irs less than the full amount you owe.

How to settle with the irs. Ad get free irs status & settlement options report+free penalty relief+free 2021 tax return! Setting up a payment plan is probably the best way to go, resulting in the least cost and detriment to you. Ad let us find you the best tax relief company in your area & get help with back taxes.

You've likely seen and heard ads from companies claiming they can settle your debt with the irs for pennies on the dollar. they claim you need their services to strike a deal. Determine if you are current on your tax obligations. In principal, settling with the irs is like settling with any other creditor:

Amend ghost returns — in some cases, if you. If irs accepts your offer, continue to pay monthly until it is paid in full. Get help from the best irs tax experts in the nation.

With this book, you will learn about the offer in compromise program that lets you settle your tax bill for a small fraction of what you. If you qualify for a. Note that when you submit a request to the irs for an installment.

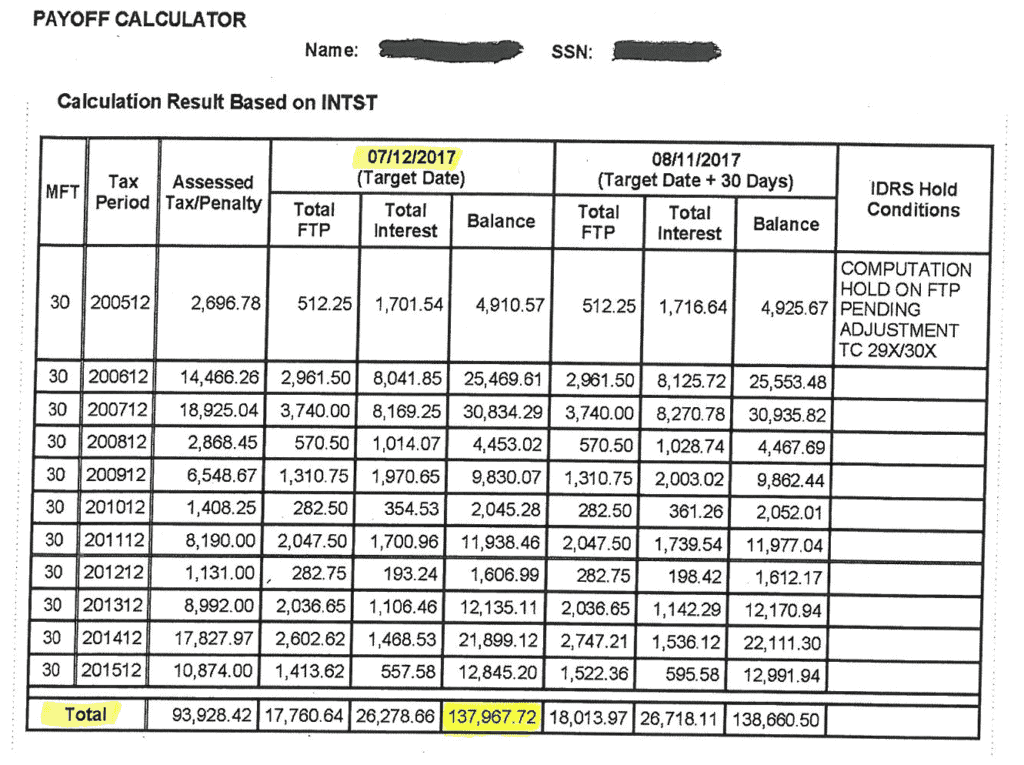

Tax settlement through partial payment installment agreements through the partial payment installment program, you make monthly payments on your tax liability, and at the end of your. See if you are a good candidate for an oic, ppia, cnc & more. How to settle taxes owed file back taxes —the irs only accepts settlement offers if you have filed all your required tax returns.

Ad as heard on cnn. You demonstrate to them that you cannot pay the full amount of the debt and offer them something less than that as. End your irs tax problems.

/images/2019/06/10/woman-settles-tax-debt.jpg)