Marvelous Info About How To Apply For Auto Loan

.jpg?sfvrsn=79728d83_0)

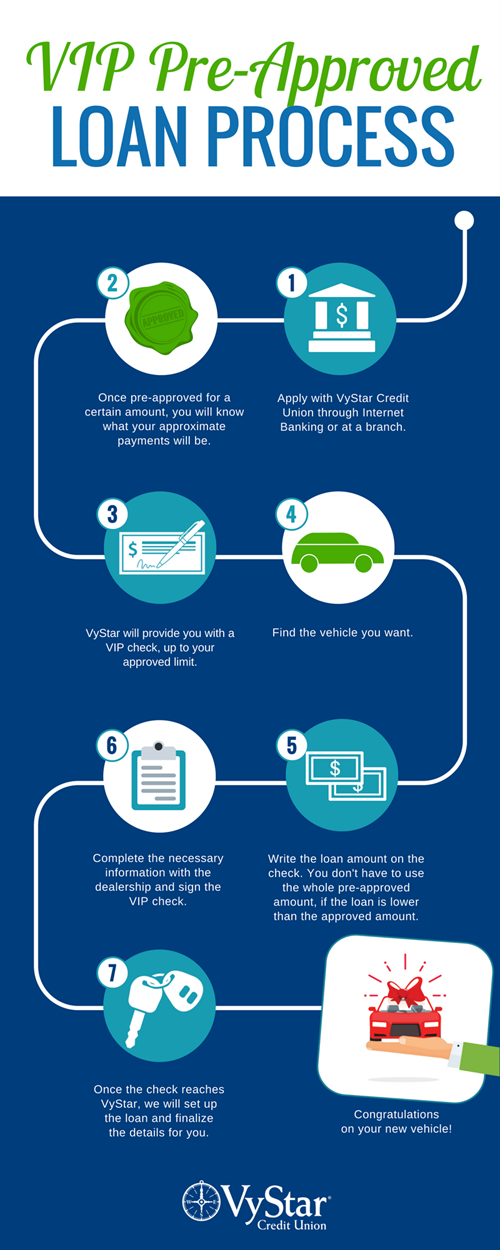

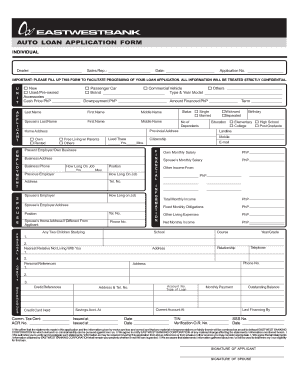

After finding a car, it’s time to officially apply for your auto loan.

How to apply for auto loan. Discover how auto refinancing works, how to apply, and where you can find the best refinancing options. Refinance auto loan rates can start as low as 1.99%. You, the persona assuming the loan, and the lender will work together to come up with terms for the new loan that works for everyone.

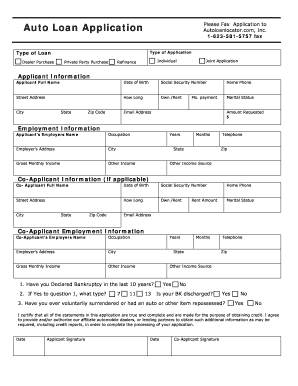

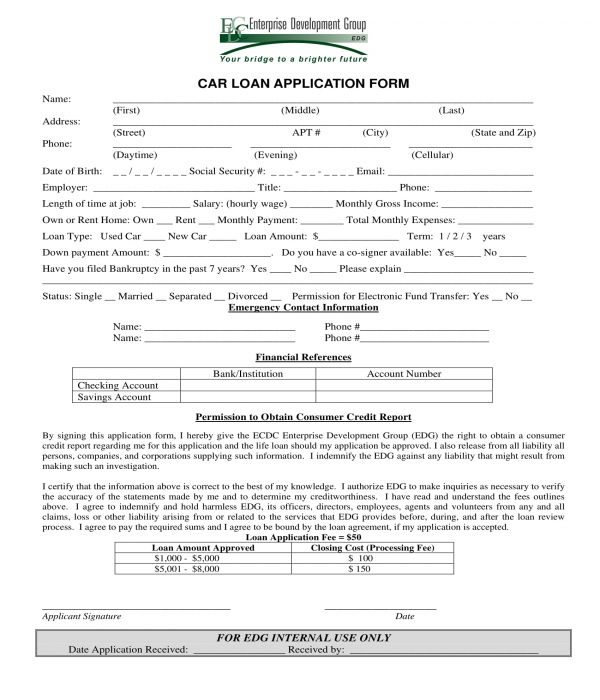

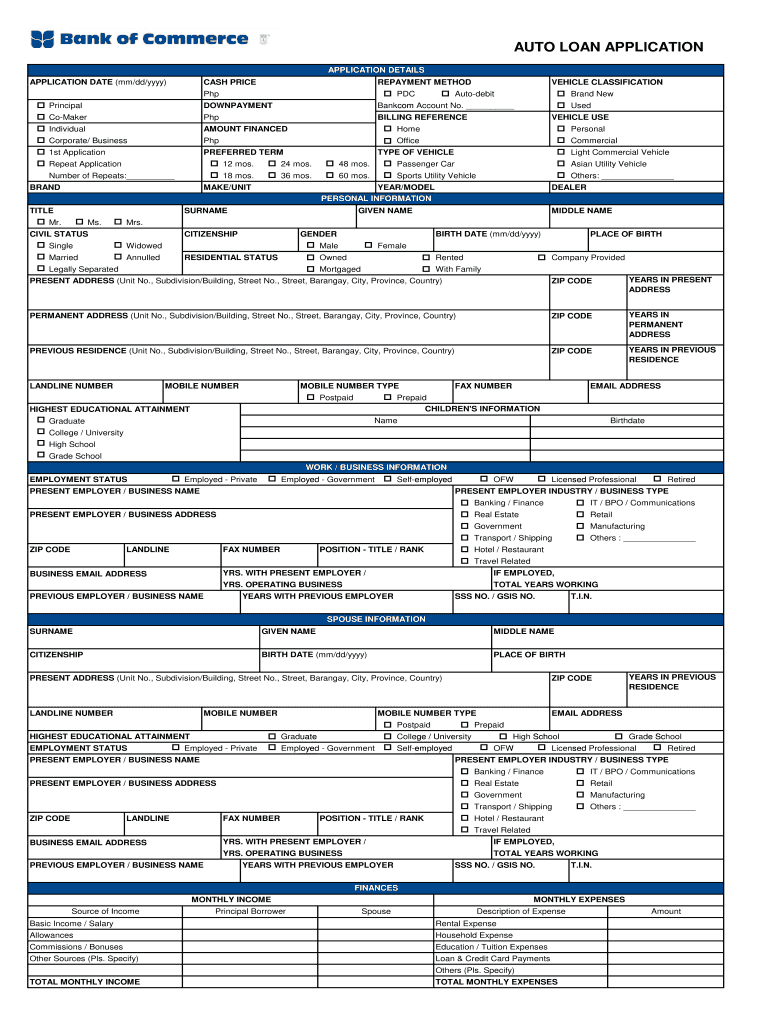

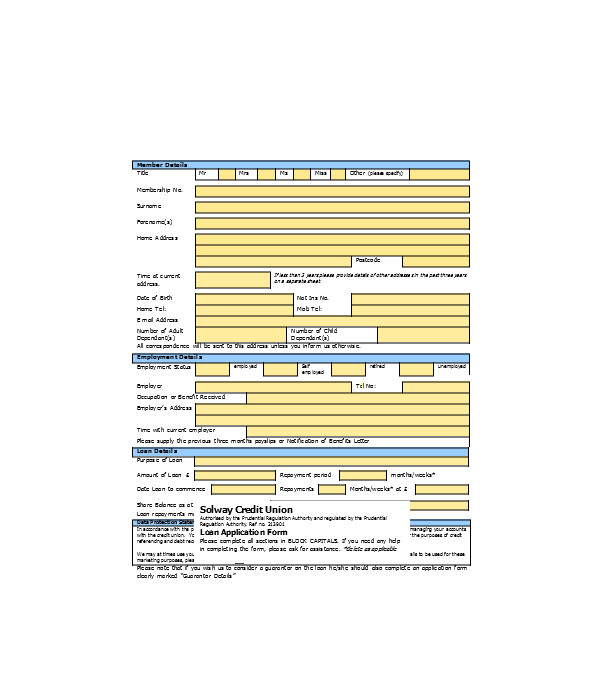

You may need to share your name, contact information, social security or tax identification number, mortgage. Compare rates & save money! Apply for an auto loan with these 4 steps.

As a result, it’s difficult to cover the whole thing in cash. Keep your existing credit cards open as you continue to pay down their balances. Wells fargo auto provides auto financing from $5,000 to $110,000 on new and used vehicles up to 15 years old, but doesn’t offer vehicle refinancing, according to a bank.

Options based on your details. Online banking customers may apply online for an auto loan to purchase a vehicle from a private party (an individual seller). Bad, low, poor.$7,000 to $48,000 approvals for a new or used car.

This can happen at the dealership, or you can apply online and show up at the dealership with financing. In order to buy or lease a vehicle with ally, first you’ll need to visit your local dealership. The comfort of a simple private auto loan is priceless.

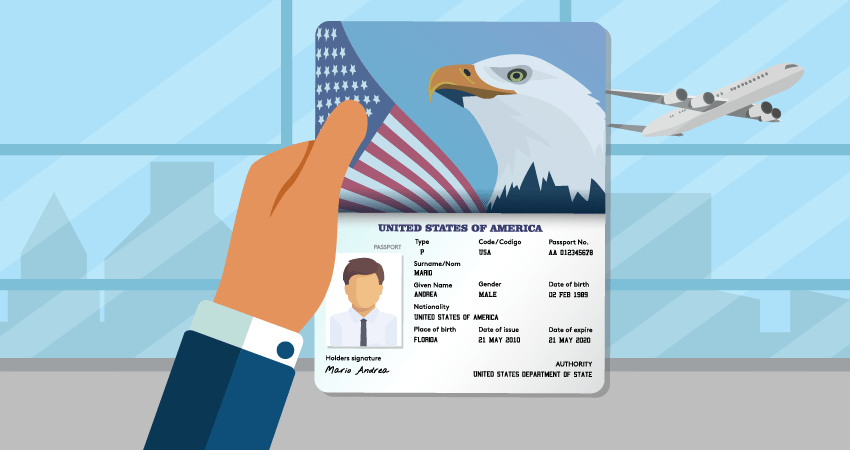

Get approved for a financing based on your needs and within your budget, with competitive lending rates. 550+ credit score, no open bankruptcies, $24,000+ annual income, us citizen or permanent resident, 18+ years old. Ad click now & choose the ideal auto loan services for you.