One Of The Best Tips About How To Find Out The Rrsp Limit

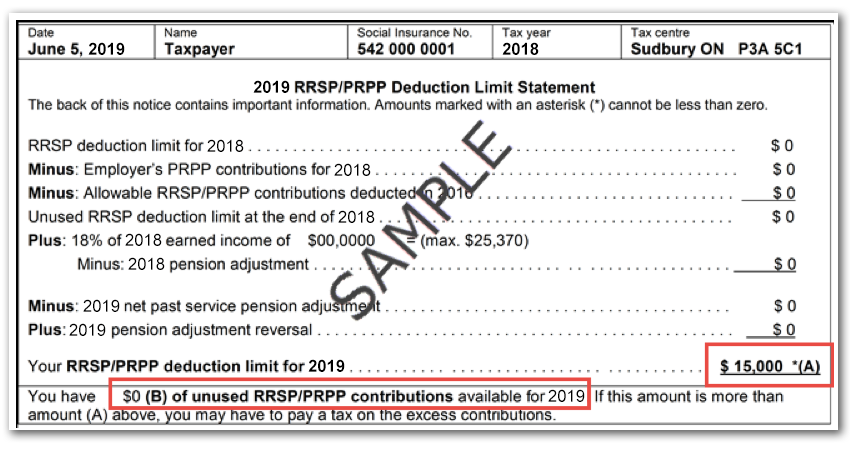

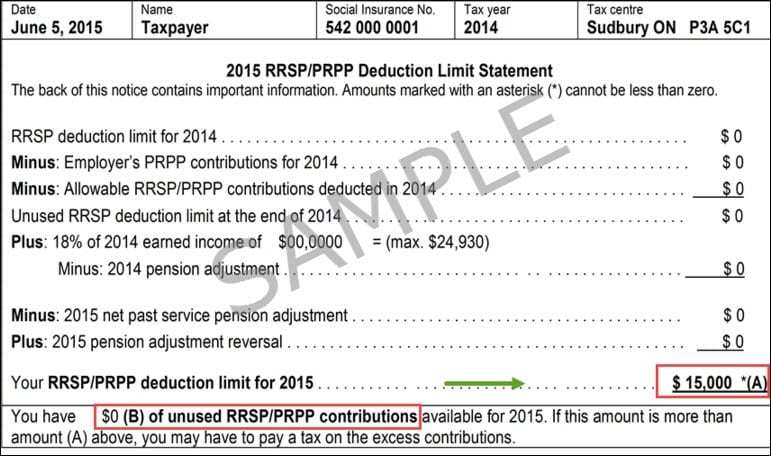

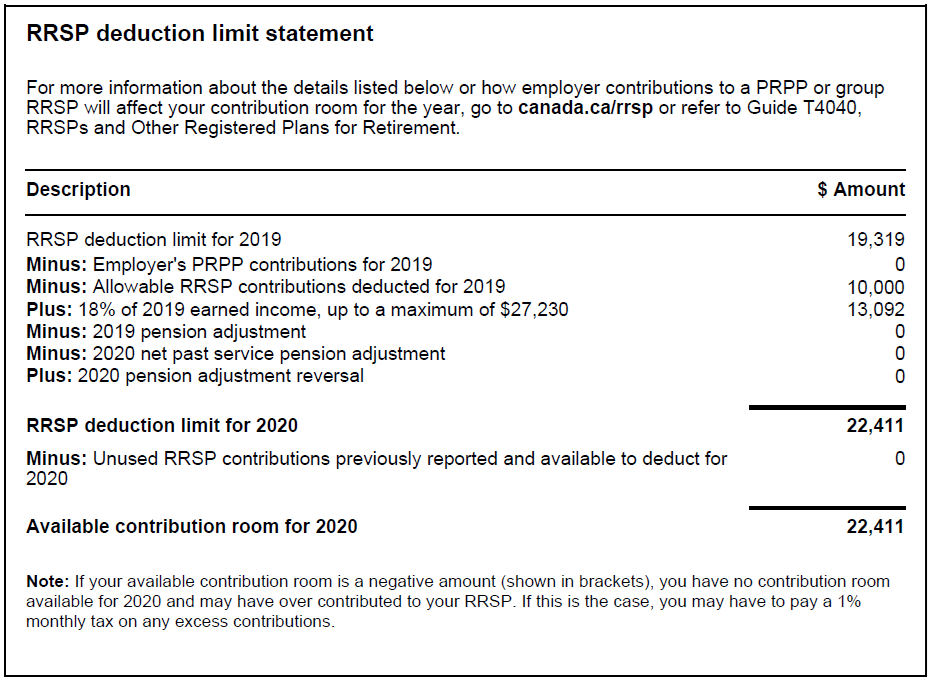

The best way to know how much you can contribute for the current year (also known as your rrsp deduction limit) is to check your most recent notice of assessment from the cra.

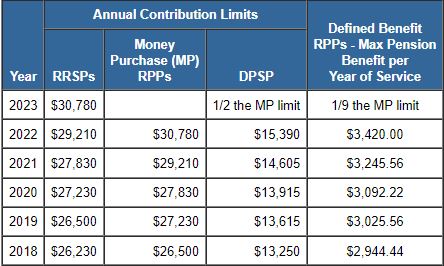

How to find out the rrsp limit. Click on rrsp and you will be directed to a page displaying your. Look under chapter 2, and click calculating your (year) rrsp deduction limit. the third paragraph includes a link. For 2021, the rrsp contribution limit is $27,830.

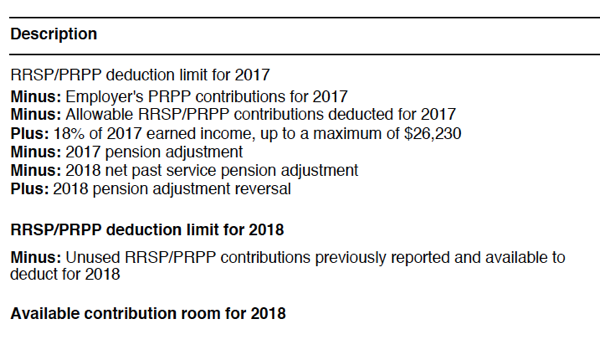

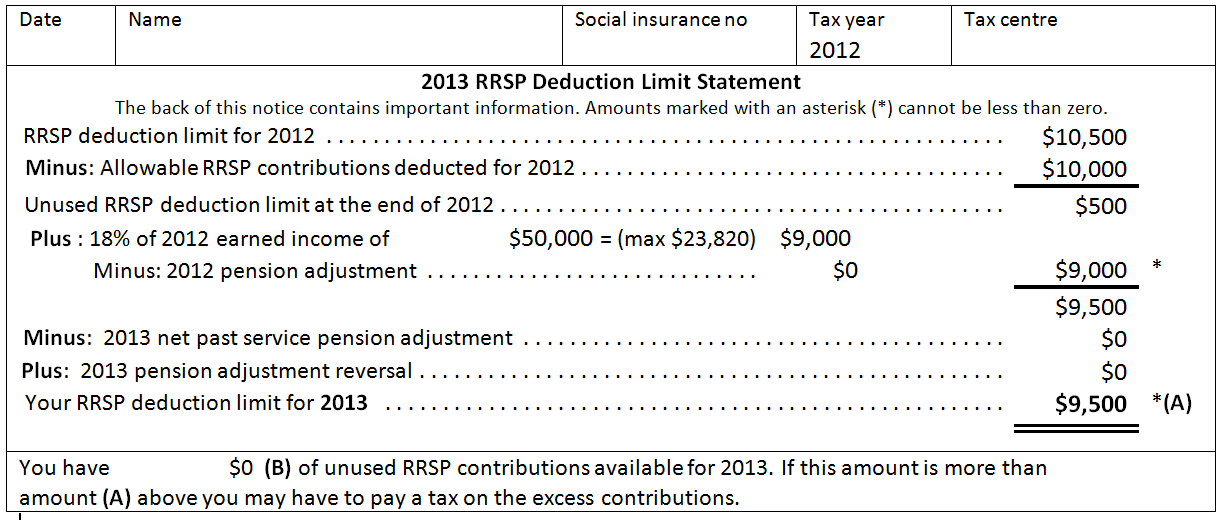

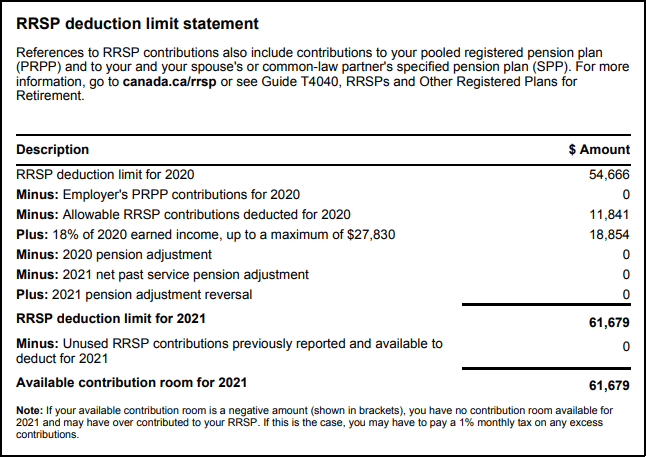

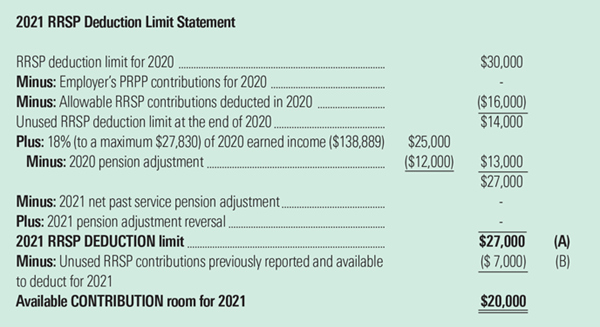

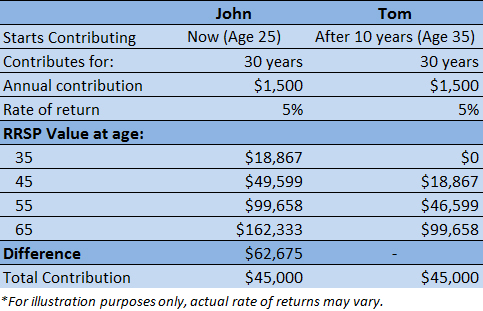

Your unused deduction room at the. Calculate 18% of your previous year’s earned income,. They will report it on your notice of assessment each year under the heading “available.

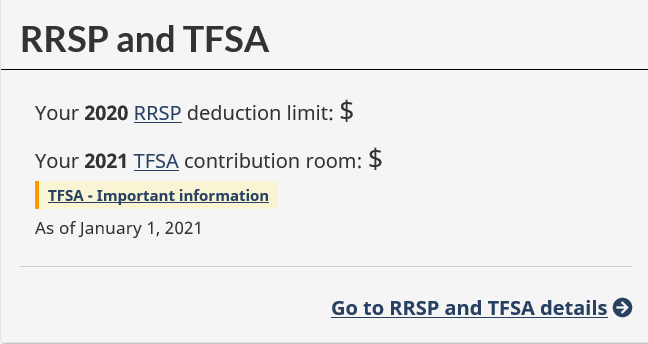

Cra may send you form t1028 if there are any changes to your rrsp. How is your rrsp limit calculated. To find out, log into the canada revenue agency’s my account service and click on the rrsp and tfsa tab.

Earned income x (maximum rate allowable for rrsp (18) /100) = maximum amount deductible rrsp. The rrsp contribution limit in past years, the general rule has been that you can contribute the lesser of 2 numbers: You can find your limit on your latest notice of assessment under the heading “available contribution limit.”, it’s also easy to find your contribution limit online using the.

How to figure out your rrsp contribution limit to see your current rrsp contribution limit, including value carried forward, look at your most recent notice of assessment from the. And for 2019, the limit was $26,500. Finding your own rrsp contribution limit for 2022.

Log onto the canada revenue agency's website, and click on form t4040(e). 18% of your income or $29,210. How is your rrsp deduction limit determined?